A critical look at crowdfunding

Introduction

- Technical innovations (Web 2.0) and a growing acceptance for the Internet as a place of cultural, social and economic activities, enable new connections between creative and financial interests. The resulting need for exchange of creativity, knowledge, labor and capital is the basis for the emergence of crowdfunding platforms as interfaces between the involved stakeholders. Theese platforms offer new forms of access to implement projects and provide site visitors with a variety of statistics (mostly) successful and completed projects. Key questions are:

Which motivation do the stakeholders have?

Which factors may influence these motivations?

How transparent are crowdfunding platforms? Which economic scenarios are expectable?

Phases

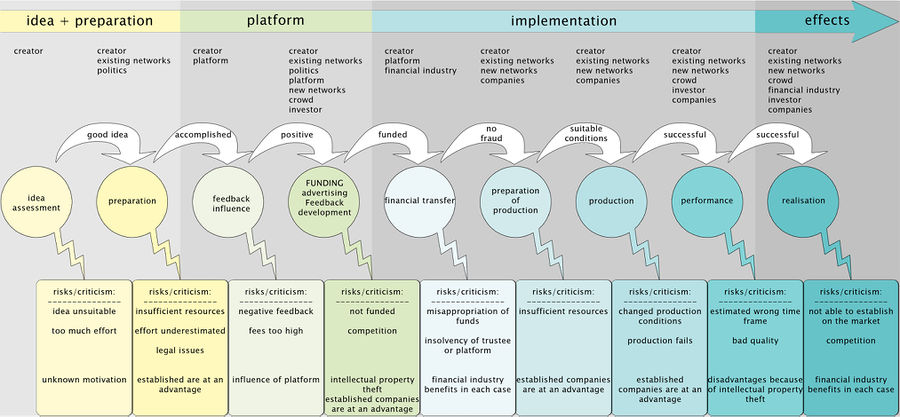

With our work/project we want to show which possibilities and dangers are embedded in this still so young idea. Here is an example of a crowdfunding process, which is divided into four phases (idea + pre-assessment, platform, implementation and execution). Within these phases, those points were identified, in which either a partial or a complete failure of the project is possible. Highlighting these points, following the stages of the first conceptualization of the idea to the final realization of the project , an overview will be provided describing economic risks associated with crowdfunding, involved actors and existing problems as well as possible reasons for the failure of a project.

Chart - The process of crowdfunding

- The process of crowdfunding (risks, criticism and requirements)

Phase 1 - Idea / Preparation

Undoubtedly a crowdfunding project cannot exist without a "creator". The initiator of a project is the creator. Before a project will be released on the crowdfunding platforms, enough preparation time needs to be considered (full-time job!). A necessary condition for a successful project is to make a good plan. Also important is to build up the crowd even before starting a crowdfunding campaign. Therfore it will be necessary that the creator keeps up networking as much as possible, for example via events, social media or newsletters. The creator must be aware of the steps ahead, he should realize which costs and expenses await him. During this preparation phase he should estimate, if enough financial, mental and temporal resources are available to make his idea a suitable match for a crowdfunding project. At the beginning the creator needs to decide, which players to include during this preparation phase.

The creator can be an individual as well as a company. Of course a company has a better starting position than a private because of resources, like employees or other options. The most important question about this is, that you never know who the creator really is and what is his motivation. Behind the visible creator could stand a hidden player.

A competitant could generate lots of advantages by industrial espionage and intellectual property theft. It is possible that in this whole system actors exist who make a lot of profit, even if a project fails.

It can be expected that there are stakeholders with dishonest intentions. One example is a creator with intention to defraud.

Phase 2 - Platform

After preparation, the project will be presented in a crowdfunding platform. Usually people like to invest in players / projects the good reviews accommodate. The higher the rate of success of a project, the more customers will be achieved. The presentation of successful projects and invisibility of failed projects can be found in many platforms. It is also interesting that many crowdfunding platforms don`t want to get responsibility.

Many platforms don`t offer a investment Advice, that was strikingly [1] In some of the cases examined by the Labour in Austria platforms are no imprints visible. The factor "Unknown" exists also on the crowdfunding-platforms. „For consumers it is not easy to see clearly the business line from the crowdfunding-platform provider. On the other hand, some platforms show her imprint. For example: If we check www.crowdfunding.at, we see that the owner of this page is a bank. When we think about the fact, that large financial institutions are quite interested in crowdfunding platforms , which motivation and actors we can guess it? Can a bank give me a feeling of security or exploitation? What risks are known and which are unknown? What is the future of crowdfunding systems?

See also, Platform Disputes, The Role of Platforms in Crowdeconomies.

Phase 3 - Implementation

The goal of these projects is their realization, not their funding. Since the project can fail at any state, this goal moves out of focus although funding was a success. As next step, the money transaction from trustee to funder is taking place, which is aometimes cause for payment service disputes The platforms charge considerable fees, but they are hardly mentioned in their General Terms and Conditions subscription. The platforms themselves keep roughly 5% (percentage varies) of the collected amount. Additional 3-5% charges are deducted for the money transaction as credit card fees [2]. Therefore it makes no difference for big companies and the financial industry (e.g. PayPal) whether the funding is successful; they are making a profit regardless of the outcome of the project. [3] Transferring the money to the creator carries a considerable risk: high amounts can mislead the creator to embezzle the transferred money. In some cases fraud is the real motivation behind a funding campaign. Prosecution is not feasible, because of the small amounts transferred by individuals.

Underestimating the actual effort is another risk which can lead to missed deadlines. There are several factors which are typically underestimated: project scope, implementation effort, budget till, product quality, etc. Creating a new product always carries many risks and unknowns which are impossible to be determined in advance, especially by inexperienced entrepreneurs.

Phase 4 – Realisation / Effects

Customer satisfaction is hard to determine even if the project was delivered successfully. All expectations cannot be fulfilled, of course, but it is unclear if the project rewards are useful. In most cases they can be described as gift articles like coffee mugs or a thank-you card. The future success of the creator is not guaranteed, just because of a single successful project.

Economic issues

Particularly in times of low rates and yields, investors and speculators are interested in new investment opportunities. Crowdfunding allows them to invest in processes and services that previously have not been a capital good. This leads to a shift of capital in these new markets. Investors and speculators often look for investment opportunities here. The interest burden is shifted into these areas as well, because of higher loans than in the regular market. The larger amount of capital goods and the higher returns lead to an increase of the monetary mass.

Can you donate me a click?

The area of collecting donations is also affected by crowdfunding. The platforms provide opportunity for donors to send (small) amounts of money to a variety of projects through service providers such as PayPal, credit cards, etc. Donating small amounts of money through easy transactions can make the donors only superficially inform themselves about the project. Even in fundraising, fees need to be paid, so the intermediary platforms (financial services, etc.) benefit from each donation.

However, small amounts and easy payment entice also the donor to inform himself or herself just superficially about the project. A further discussion of the causes or the output of a project also appears too elaborate.

Education, a crowd investment?

Education is a basic right.

[4]

However access to higher education is seldom for free. [5] There are national scholarships and laws like BaföG

[6] in Germany, which should support an equal accessibility to education, but they are insufficient to guarantee access for each student. This urges many students to take out a loan from a bank. Crowd funding as a modern and apparently bank-independent way of fund raising is already used as an alternative.

[7]

But which are the risks and chances resulting from this new, crowd-based way of financing education?

This way of funding might give the opportunity to have access for education to many people around the world. But this should not hide the fact, that education is supposed to be free for everyone. States with poor infrastructure which aren't able to provide education for everyone might be an exception, better developed countries are responsible to offer free education to their citizens paid by taxes.

In this case crowd-funded-education fights the effect and not the cause, by a privatisation of public responsibility.

Further it should be considered that the laws of the market are also existing in crowd-based-markets. There is a fixed yield which has to be generated by the borrower. Sometimes this yield is much higher than the yield demanded by national scholarships.

[8]

This causes a higher debt for the borrower and so a higher risk of default for the investor.

Fair Trade and Crowdfunding

Crowdfunded projects offer many chances for fair trade. To have a good conscience customers like so invest in social projects. A critical point is that the presentation of a project can be faked easily. The process and actors are once more hidden. The platforms do not feel responsible for the projects. They will not prove the authenticity of the projects.

Another problem is that there exist more than 22 fair trade seals. The creator can use them, but you will never know, if the production takes place under Fairtrade Standards or what is the motivation behind the Fairtrade marketing.

Links

References

- ↑ https://www.seedmatch.de

- ↑ https://www.kickstarter.com/help/fees

- ↑ http://media.arbeiterkammer.at/PDF/Crowdfunding_Verbraucherschutz_2014.pdf

- ↑ http://www.un.org/en/documents/udhr/index.shtml#a26

- ↑ http://de.wikipedia.org/wiki/Studiengebühr

- ↑ http://de.wikipedia.org/wiki/Bundesausbildungsf%C3%B6rderungsgesetz

- ↑ http://www.spiegel.de/unispiegel/wunderbar/studenten-als-geldanlage-investieren-in-studenten-von-witten-herdecke-a-1004367.html

- ↑ http://www.spiegel.de/unispiegel/wunderbar/studenten-als-geldanlage-investieren-in-studenten-von-witten-herdecke-a-1004367.html