Difference between revisions of "Bitcoin: strengths and weaknesses of P2P currencies"

Wikidoctor (Talk | contribs) |

|||

| Line 1: | Line 1: | ||

| + | __TOC__ | ||

[[File:1418208394399475 (1).jpg|400px]] | [[File:1418208394399475 (1).jpg|400px]] | ||

Revision as of 13:20, 21 May 2015

Contents

[hide]Money has often been a cause of the delusion of multitudes. Sober nations have all at once become desperate gamblers, and risked almost their existence upon the turn of a piece of paper.

Charles Mackay, Memoirs of extraordinary popular delusions and the madness of crowds (1852).

Why Bitcoin?

Have you ever wondered how is it possible that, being already way into the 21st century, we can make a free HD video call to a friend living in the antipodes, but we still can´t send money to that same friend without having to pay a massive amount of fees? Theoretically, thanks to the communication technologies sending money could be as easy as it is to send a photo or a video. However, given the crescent flow of migration within the global society, a considerable amount of people still has to deal with transaction fees and commissions almost in a day-to-day basis. The reason for this is that unlike photographs, which can be in x computers at the same time, money transactions have to be verified as so to avoid that the person A does not “double-spend” the amount of money already sent to person B. Until recently, a trusted intermediary would be hired in order to control this.

Nonetheless, in order to verify and control monetary transactions, this central authority (generally a private bank to a state) will also have the the power to to settle a central payment ledger, regulate and preserve the value of money and even to withdraw it from circulation. All this capacities entrusted to the central authority will, on the one hand, ensure the viability of the monetary system, but they also imply that the fate of the whole economic structure will be depending on that central authority and its economic interests, interests which usually end up enforcing also political pressures.

The emergence of cyber-utopian ideals that accompanied the advent of communication technologies during the 1990s generalized the awareness of the possibilities that this technologies enabled in order to achieve an independence from economic and political powers. Bitcoin, the world´s first totally decentralized and distributed virtual currency, was born precisely in 2009 in order to apply the potentialities of communication technologies to get the crowd independent from monetary centralized institutions, thus facilitating the future formation of real democracies. As its creator Satoshi Nakamoto would argue,

“The root problem with conventional currency is all the trust that is required that´s needed to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let thieves drain in our accounts. Their massive overhead costs make micropayments impossible”[1]

The million-Bitcoin question: how does it work?

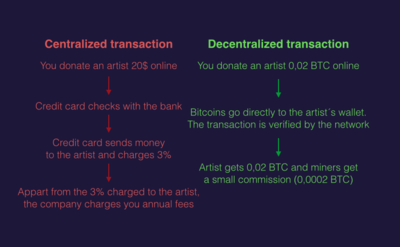

Bitcoin proposes to substitute this trust in which central authorities are based by using a block chain through which each transaction can be publicly known by all the participants within the Bitcoin network. In Bitcoin there is no company, no Bitcoin building or server. There are no third parties or intermediaries (Visa, Paypal, Mastercard, whatever), but it is the participants of the network who verify the transactions and sustain the system. Although all transactions are publicly available in a shared transaction register (ledger) and identified by the Bitcoin address, the history of each coin is encrypted in a string of letters and numbers that is not systematically linked to an individual. Bitcoin is therefore said to be “pseudoanonymous”.

Bitcoin is also said to be cheaper and faster that traditional intermediaries. Small business and artists, who often rely on small donations, do not need to pay merchant fees to third parties if using Bitcoin. That allows donations and small electronic payments better. It also works well for legal but controversial payments. Wikileaks donations, for instance, even if they weren't illegal whatsoever, were mysteriously not working when the Paypal accounts were opened public. It was said to be was the government imposed political pressure on the companies. That can´t happen with Bitcoin because there is not a centralized company upon which you can put pressure on.

One of the most frequently asked questions between potential users is how Bitcoins can be earned. There are several answers to that.

Mining Bitcoins

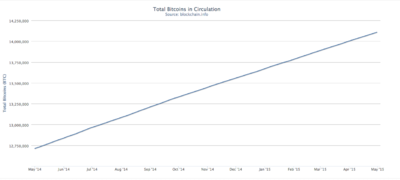

Bitcoins are originated through a process called mining. In the early days of Bitcoin, a user could easily put his computer in service of the Bitcoin network to contribute to its maintenance and the computational power needed for the verification of each transaction. The Bitcoin software that is downloaded by the user is put to solve the mathematical algorithms[2] needed to approve Bitcoin transactions. The more computing power you contributed (also the higher your internet and electricity bill gets), the bigger amount of Bitcoins you would get as a reward.

However, the process has been highly professionalized and an individual computer can no longer mine Bitcoins. The Bitcoin network automatically changes the difficulty of the mathematical algorithms that need to be solved to obtain the Bitcoins, so an individual user can no longer do it fast enough. Now, a special type of hardware is needed[3], and the users that own this hardware usually work together in teams (“pools”) in order to solve the problems faster. Each participant of the pool gets a reward proportional to his/her contribution.

It is important to notice that, although Bitcoin is thought to decentralize economic resources, its material dimension is still dependent from he legislation of nation states and economic powers. The professional Bitcoin mines working at full capacity 24/7, for instance, produce a massive amount of e-waste that usually end up being processed in unindustrialized countries like Ghana, and which processing is creating serious health and environmental problems, as well as contributing to the precarious labor conditions of the majority of the population.

Using Adam Smith´s An Inquiry into the Nature and Causes of the Wealth of Nations, Paul Krugman (2013) argued in the New York Times that Bitcoin mining amounts a “drastic retrogression” because of people thinking “it’s smart, nay cutting-edge, to create a sort of virtual currency whose creation requires wasting real resources in a way Adam Smith considered foolish and outmoded in 1776”[4]. The ecological dimension of Bitcoin is however hardly mentioned in most of the articles about the cryptocurrency[5]. Still, the Bitcoin Wiki unconvincingly address the issue by asserting that Bitcoin is “No more so [harmful for ecology] than the wastefulness of mining gold out of the ground, melting it down and shaping it into bars, and then putting it back underground again. Not to mention the building of big fancy buildings, the waste of energy printing and minting all the various fiat currencies, the transportation thereof in armored cars by no less than two security guards for each who could probably be doing something more productive, etc.”

Other ways to earn Bitcoins

Apart from mining them, there are several other ways to obtain Bitcoins. You can either

- If you have a business , you can accept Bitcoin as a means of payment. You only have to download a Bitcoin wallet (the free, open-source software that allows you to store and manage your Bitcoins) and Display a QR-code with your Bitcoin address next to your cash register. Since there are no third parties involved and thus no commissions at all, Bitcoin also works well for micro-payments. To accept your tips through Bitcoin.

- You can get small amounts of bit coins by completing tasks in certain websites such as BitVisitor or CoinWorker.

- Although there are not many organizations that do it yet, you can also get your monthly paycheck in Bitcoins, or at least a little part. BitGigs and Coinality offer a list of current Bitcoin payed jobs.

- You can buy them from a friend or directly from an exchange with your bank account.

Once you get your Bitcoins, you can start trading them online and offline and no central authority will keep either records or fees for your transactions. There is a crescent amount of businesses that accept Bitcoin as a mode of payment, including Microsoft, Amazon, Subway, Victoria´s Secret, Domino´s Pizza, Apple among plenty of others. However, Forbes Magazine published and article in January 2015 warning about how, even if some retailers have started accepting Bitcoin as a mode of payment, “most immediately convert them into dollars – which means every time someone uses Bitcoin to pay for goods or services the currency loses value. It’s basically an elaborate Ponzi scheme.”[6]

Once you make your mind clear about the practical operation of Bitcoin, some questions are still remaining, most of them related to its theoretical fundaments. What is then a Bitcoin in itself and why does it have any commercial value?

Bitcoin: the virtual gold

The Bitcoin network was launched in 2009 as a combination of cryptography, a form of secret writing mainly developed after WWI, and a monetary philosophy derived from the Austrian economist Carl Menger (1840-1921). Menger basically defended a “socio-logical” theory in which we use money instead of bartering simply because is easier to trade than any other commodity. That is precisely why money should be linked to any scarce natural resource such as gold. Similarly, a Bitcoin is simply a string composed by a unique (cryptographic) combination of letters and numbers and which value is derived from how much individual users are willing to pay to obtain them: it is a currency based in the formula scarcity+utility=value. In that sense, Bitcoin is like cash: you can´t spend money you don´t have (like in traditional payment methods). Likewise, as Professor Nigel Dodd posits, Bitcoin could be considered as a “virtual form of gold” (Dodd, 2014: 362). However, unlike gold, Bitcoin do have a settled limit of bit coins that can be “mined”: it is capped at 21 million bitcoins, projected to be reached by 2140. Also, it can not be either confiscated or subject to political pressure.

Bitcoin´s volatility also makes it differ from the precious metal. Its value often soars in relation to the US dollar, but it also crashes frequently due to either the insufficient liquidity or the uncertainty about its future value[7]. Today, Bitcoin market is around 10 billion dollars (very small) so any small change will make it fluctuate. Bitcoin is then not a good store of value but a good medium of exchange. However, simultaneously, Bitcoin scarcity makes it specially attractive as a store of value (and therefore as an instrument of speculation) In order to avoid hoarding, the Freicoin Foundation, which is linked to Occupy Wall Street, is currently developing a version of Bitcoin that uses demurrage to avoid speculation.

Even so, according to Dodd, the fact that Bitcoin is based in the absence of trust and in viewing money as a thing, makes it “arguably reliant on an extraordinarily old-fashioned, even reactionary, image of money” (ibíd.) Considering that the crescent public interest towards Bitcoin[8] is intimately connected with the cyber-utopian, revolutionary potential of the virtual currencies, the clarification that its consideration of money is essentially traditional results extremely compelling when analyzing the reasons for the excitement of certain sectors of the internet.

Appart from Menger, some of the main ideas underlying the concept of Bitcoin were published in several papers between 1980 and 2000. In “Blind Signatures for Untraceable Payments” (David Chaum, 1983) a payment system that combined the anonymity of cash and the security ob banks was proposed (Dodd, 2014: 363). In the late 1990s Wei Dai combined his cryptographic knowledge with the recently developed ideology of cryptoanarchy to promote the idea of B-money, a system that allowed to establish a medium of exchange that do not rely in the government or a central bank for its correct functioning. Around the same time, Nick Szabo developed the idea which would be the direct precursor Bitcoin. Szabo´s Bit gold would consist of “valuable electronic bits (created through a “proof of work” generated from a public string of bits) that cannot be forged, and whose creation is both finite and independent from any third party” (ibíd.)

Along with Hal Finney, the first person to ever receive a Bitcoin transaction, both Dai and Szabo are rumored to be Satoshi Nakamoto, the widely accepted as creator of Bitcoin. Nakamoto actually published the Bitcoin in the Extropy-chat, one of the oldest mailing lists still active and also the “longest running transhumanist email list” today. Apart from their work on e-cash frameworks, Finney, Dai and Szabo have been said to be behind Satoshi Nakamoto because of their active participation in the Extropy mail list.

The legend of the mysterious Satoshi Nakamoto has always contributed to the fame of Bitcoin. His name, along with the hesitation over whether he is a man, a woman or a collective pseudonym, appears in almost every publication about the cryptocurrency. However, in April 2015 the executive director of the Bitcoin Foundation suggested to remove the name of Nakamoto along with the rest of founding members of the organization. His words suggest that “the intent of the change would be to underscore that the Bitcoin Foundation is a decentralized network, one that he believes should work to avoid venerating individuals over collective goals.”

As it´s been suggested, Bitcoin´s independence from third parties is both its strength and what makes it more vulnerable, since it “might undergo a deflationary spiral that causes certain individuals or industries to abandon Bitcoin, possibly causing a panic or just a permanent depression in Bitcoin’s value (…) The end result of such a spiral is underemployed human capital and other means of production and destruction of wealth.” (Groshoff, 2014: 518). However, Bitcoin´s volatility makes the currency very suitable to countries such as Argentina, where it has become increasingly popular. Because of Argentina´s natural economic instability, people have a better predisposition when it comes to experimenting with new modes of storaging and exchanging money. As the New York Times explained, Bitcoin “first became popular in the places that needed it least, like Europe and the United States, given how smoothly the currencies and financial services work there. It makes sense that a place like Argentina would be fertile ground for a virtual currency. Inflation is constant: At the end of 2014, for example, the peso was worth 25 percent less than it was at the beginning of the year. And that adversity pales in comparison with past bouts of hyperinflation, defaults on national debts and currency revaluations. Less than half of the population use Argentine banks and credit cards. Even wealthy Argentines fear keeping their money in the country’s banks.”[9]

Appart from the fact that Bitcoin is prone to bubbles and crashes, it also shows an endemic weakness in the possibility of a reduced group of miners controlling the whole system, a weakness that have been much less discussed that the volatility of the crypto currency (Dodd, 2014: 365). In Nathaniel Popper's new book, Digital Gold, the author gives account of the various speculative processes carried out through Bitcoin, and say that only ”misfits" and “millionaires" are responsible for the building, mining and hyping of the digital currency.

Bitcoin has also received recent media criticism because of the supposed domination of male participation within the network. According to data compiled by coindesk.com, the Bitcoin community is 96% men.

Popularity and public response

Although a crescent amount of people are informed about the existence of Bitcoin, one of the reasons why its popularity is growing relatively slowly is the difficulty to understand its functioning. The internet is plagued with tutorials and “how-tos” but they al result as cryptic as the bitcoin in itself. Users usually express their impotence in the commentaries, and most of them share the impression that bitcoin “is so frustrating to understand”, “still doesnt make any sense” after watching the videos, and that “everything about this seems to be shrouded in mystery”.[10]

Bitcoin has indeed acquired a cultish aura. Some have even tried to link the cryptocurrency with satanism. Apart from this rather radical sectors, Bitcoin presents itself as a “highly competitive, dynamic, almost perfect, market” in their own wiki platform, which acts as a sort of a bible and is created and maintained by the Bitcoin community. The Bitcoin wiki is devoted to praise the system and to dismantle any doubts, myths or “misconceptions” about the cryptocurrency. That would not be strange if the platform weren't using a sort of an aggressive discourse in which every single critique one might have is answered in advance through “so you do too” kind of arguments. If a user is for instance worried about Bitcoin being harmful for ecology, the wiki will decline the critique by saying that the “dismissal of Bitcoin because of its costs, while ignoring its benefits, is a dishonest argument. In fact, any environmental argument of this type is dishonest, not just pertaining to Bitcoin.” This sort of “moral superiority” is employed also in Bitcoin forums, and along with their characteristic excessive enthusiasm sometimes makes the community become subject of contentious puns and parodies.

The aesthetics of Bitcoin similarly support that view. Bitcoin representations “usually rely on a selection of visual clichés like the Bitcoin logo, anything that looks computer-y, and anachronistically physical money”[11]. However, Bitcoin is increasingly invading the art scene through both Bitcoin-themed fan art that sells for thousands of Bitcoins and specialized online galleries that only accept Bitcoins as a mode of payment.

Besides, almost every Bitcoin tutorial is full of cryptic language and warnings that can discourage the potential users. Most of Bitcoin literature can only be found in specialized magazines and webpages full of economic slang. All this, plus to the prevailing ignorance about the mechanisms of money and the markets in general makes the task of learning about Bitcoin almost a full-time job.

Although US and European regulators have started to focus Bitcoin, the entrepreneurs are finding ways to scape the legal systems. After in March 2013 the U.S. Treasury Department stated that “all businesses which engage in “the exchange or transfer of [Bitcoin] will be considered ‘money services businesses”, many people relocated in Latin America in order to scape the Law. As the founder of bitcoinstore.com stated in the Financial Times, “[e]ven if US regulations make it hard for Bitcoin businesses to operate in the US, that doesn’t mean it will make it difficult for people to use Bitcoin as a currency in the US. Bitcoin is a world currency” (Groshoff, 2014: 523). Following the same dynamics, the Bitcoin community states in the wiki that “there is no known governmental regulation which disallows the use of Bitcoin”[12]. However, between late 2014 and 2015 some countries such as Bolivia, Ecuador, Vietnam, Thailand and Russia have explicitly banned Bitcoin. Still, in some places like Indonesia Bitcoin will be illegal but wont punish or sanction users. We could then say that Bitcoin “currently operates in a legal grey area” (ibíd.)

But if Bitcoin operates freed from the authority of the government, it is still dependent on electricity, internet, technology and communication platforms in general. It may have emancipate connected to the willings of the market. Isn´t that the neoliberal dream? Thanks to the Bitcoin experiment, Apple and Facebook, for instance, are starting to develop their own electronic, p2p payment systems.

Considering that the most important sources of financial information (TV and internet) are precisely derived from the same communication platforms upon which Bitcoin is entirely dependent, could it be that the social potential of Bitcoin is being silenced by the markets behind cryptic tutorials and highly specialized publications that are almost impossible to understand by the average citizen?

Do companies benefit from retaining Bitcoin as a minor experiment while giving themselves some time to introduce this new monetary trends into their field of action? While Bitcoin does not need from the trust on central authorities to function, the majority of sources of information do need from the channel controlled by technological companies to spread their message, so at the end it is impossible to distribute it among the majority of the population.

Actually, as Bitcoin has garnered increasing media attention two popular narratives have emerged surrounding decentralized virtual currencies:

1. Virtual currencies are the wave of the future for payment systems: This is mainly defended in publications such as Wired Magazine and the Bitcoin community through chats and forums.

2.Virtual currencies provide a powerful new tool for criminals, terrorist financiers and money laundry. The online black market Silk Road, which was shut down by the FBI in 2013 attracting considerable media attention, is mainly responsible for this perception of Bitcoin, as it was the payment method employed in the transactions because of its untraceability. Apart from Silkroad, the ISIS and the Satanic Temple in Detroit are said to be accepting Bitcoin to fund its operations. The Satanic Temple is fully volunteer-based, so, according to a member, it “gives us the ability to reach out to more people and give them more options for donating if they don’t want to link their identity.”[13] The Bitcoin community, however, have replied to this kind of accusations by stating that “Visa, MasterCard, PayPal, and cash all serve as opportunities for criminals as well, but society keeps them around due to their recognized net benefit.”[14]

According to the survery published by Zerohedge.com (in bibliography), these are the most used words in descriptions of “favourite aspects of Bitcoin”

According to the survery published by Zerohedge.com (in bibliography), these are the most used words in descriptions of “favourite aspects of Bitcoin”

Start Researching

- Bitcoin Wiki: https://en.bitcoin.it/wiki/Main_Page

- Bitcoin Timeline: http://historyofbitcoin.org/

- State of Bitcoin 2015: http://www.coindesk.com/research/state-of-bitcoin-q1-2015/

- Bitcoin.org: https://bitcoin.org/en/

- Follow: Bitcoin, Bitcoin Reporter, Coinbase, Coindesk.

Bibliography

Books and PDFs

BADEV, A. and CHEN, M. (2014), Bitcoin: Technical Background and Data Analysis, Finance and Economics Discussion Series Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board, Washington, D.C., Retrieved: http://www.federalreserve.gov/econresdata/feds/2014/files/2014104pap.pdf DODD, N. (2014), The Social Life of Money, New Jersey: Princeton University Press.

BARBER, S., BOYEN, X. and SHI, E., "Bitter to Better: How to Make Bitcoin a Better Currency", Palo Alto Research Center, University of California, Berkeley, Retrieved: https://crypto.stanford.edu/~xb/fc12/bitcoin.pdf

DOURADO, E. and BRITO, J. (2014), Cryptocurrency, The New Palgrave Dictionary of Economics, Online Edition, Retrieved: http://jerrybrito.com/pdf/cryptocurrency-newpalgrave.pdf

GROSHOFF, D. (2014), Kickstarter My Heart: Extraordinary Popular Delusions and the Madness of Crowdfunding Constraints and Bitcoin Bubbles, 5 Wm. & Mary Bus. L. Rev. 489, Retrieved: http://scholarship.law.wm.edu/wmblr/vol5/iss2/4

LEE, T.B. (21/11/2013), "Here’s how Bitcoin charmed Washington", The Washington Post, The Switch, Retrieved: http://www.washingtonpost.com/blogs/the-switch/wp/2013/11/21/heres-how-bitcoin-charmed-washington/

LO, S. and Wang, C. (2014), Bitcoin as Money?, Federal Reserve Bank of Boston, Retrieved: http://www.bostonfed.org/economic/current-policy-perspectives/2014/cpp1404.pdf

NAKAMOTO, S. (2008), Bitcoin: A Peer-to-Peer Electronic Cash System, Retrieved: https://bitcoin.org/bitcoin.pdf

NEIL, I. (12/04/2013), Bitcoin is ludicrous, but it tells us something important about the nature of money, The Washington Post, Wonkblog, Retrieved: http://www.washingtonpost.com/blogs/wonkblog/wp/2013/04/12/bitcoin-is-ludicrous-but-it-tells-us-something-important-about-the-nature-of-money/

PRISCO, G. (05/10/2014), The Extropian Roots of Bitcoin, Cryptocoins News, News, Retrieved: https://www.cryptocoinsnews.com/extropian-roots-bitcoin/

QUENTSON, A. (03/07/2014), Nick Szabo (Bitcoin founder Satoshi Nakamoto?) Breaks his Silence with a Tweet, Cryptocoin News, News, Retrieved: https://www.cryptocoinsnews.com/nick-szabo-bitcoin-founder-satoshi-nakamoto-breaks-silence-tweet/

RIZZO, P. (30/04/2015), Remove Satoshi as Founding Member, Says Bitcoin Foundation Director, Coindesk, News, Retrieved: http://www.coindesk.com/remove-satoshi-as-founding-member-says-bitcoin-foundation-director/?utm_content=buffer13ec2&utm_medium=social&utm_source=twitter.com&utm_campaign=buffer

VV.AA (2014), FATF Report: Virtual Currencies Key Definitions and Potential AML/CFT Risks, FATF/OECD, Retrieved: http://www.fatf-gafi.org/media/fatf/documents/reports/virtual-currency-key-definitions-and-potential-aml-cft-risks.pdf

Webpages

What are the Advantages and Disadvantages of Bitcoin? @ https://coinreport.net/coin-101/advantages-and-disadvantages-of-bitcoin/

Alta confianza en Bitcoin entre norteamericanos, británicos y argentinos @ http://elbitcoin.org/confianza-bitcoin-norteamericanos-britanicos-argentinos/

The Demographics Of Bitcoin @ http://www.zerohedge.com/news/2013-03-10/demographics-bitcoin

Bitcoin mining @ http://www.bitcoinmining.com/

Earn Bitcoins in 8 different ways @ http://earn-bitcoins.com/

Bitcoin IRS Tax Guide For Individual Filers @ http://www.investopedia.com/university/definitive-bitcoin-tax-guide-dont-let-irs-snow-you/

................................................................................................................................................................- Jump up ↑ Satoshi Nakamoto in http://p2pfoundation.net/bitcoin Accessed: 02/03/15

- Jump up ↑ Bitcoins transactions are encrypted in groups called blocks. What mining essentially does is guessing the number that decrypt a block through complicated math operations that can only be done by certain specific softwares. It is basically like if your computer was participating in a super-fast lottery.

- Jump up ↑ Asic (Application-Specific Circuit Chips) is a special type of chip specifically designed for Bitcoin mining and which should be included in the CPU in order to make it suitable to solve the complex mathematical problems involved in the process. Several companies such as Butterfly Labs (http://www.butterflylabs.com/) or Avalon offer systems built specifically for Bitcoin mining.

- Jump up ↑ Krugman, P. (12/04/2013), "Adam Smith hates Bitcoin", New York Times, The Opinion Pages, Retrieved: http://krugman.blogs.nytimes.com/2013/04/12/adam-smith-hates-bitcoin/?_r=0, Accessed: 03/03/15

- Jump up ↑ A few short articles have been published regarding that matter though. For instance: http://www.bloomberg.com/news/articles/2013-04-12/virtual-bitcoin-mining-is-a-real-world-environmental-disaster,

- Jump up ↑ Gerber, R. (1/29/2015), "Why Apple Pay And Dollars Are Killing Bitcoin", Forbes Magazine, Investing, Retrieved: http://www.forbes.com/sites/greatspeculations/2015/01/29/why-apple-pay-and-dollars-are-killing-bitcoin/ Accessed: 03/02/2015

- Jump up ↑ According to http://bitcoincharts.com/ it has fluctuated from around 2$ in 2011 to 1,200$ in 2014 to approximately 235$ in April 2015.

- Jump up ↑ The lack of consistent and reliable surveys about the public awareness of crypto-currencies result alarming. There are several places that offer statistics concerning bitcoin, but most of them are displayed within bitcoin-oriented publications and they also differ significantly between each other. While the Wall Street Journal published in 2014 that 76% of the american population didn´t know about bitcoin and even “don´t care to know”, a consumer survey made by Commonwealth of Massachusetts Division of Banks in the same year said that only 45% of respondents didn´t know about the cryptocurrency. On the other hand, Bitcoin News said that in the UK 71% of the population have heard about it but still don´t know exactly how it works. In spite of the cyphers, most surveys do agree in the crescent public interest towards this kind of phenomena. (The references for the surveys analyzed in this article can be found in the bibliography)

- Jump up ↑ Popper, N. (29/04/2015), "Can Bitcoin Conquer Argentina?", New York Times Magazine, Accessed:http://www.nytimes.com/2015/05/03/magazine/how-bitcoin-is-disrupting-argentinas-economy.html?smid=fb-nytimes&smtyp=cur&bicmp=AD&bicmlukp=WT.mc_id&bicmst=1409232722000&bicmet=1419773522000 Retrieved: 29/04/2015

- Jump up ↑ Commentaries in the video “What is bit coin mining?” Retrieved: https://www.youtube.com/watch?v=GmOzih6I1zs Accessed: 02/02/15

- Jump up ↑ Turk, V. (10/12/2014), "The Devote and Lucrative World of Bitcoin Fan Art", Vice, Motherboard, Accessed:http://motherboard.vice.com/read/the-devout-and-lucrative-world-of-bitcoin-fan-art, Retrieved: 02/03/2015

- Jump up ↑ https://en.bitcoin.it/wiki/Myths#Bitcoin_violates_governmental_regulations

- Jump up ↑ Pearson, J. (1/05/2015), "Why Satanists Love Bitcoin", Vice, Motherboard, Accessed: https://en.bitcoin.it/wiki/Myths#Bitcoin_violates_governmental_regulations, Retrieved: 1/05/2015

- Jump up ↑ https://en.bitcoin.it/wiki/Myths